I remember

him as Sonny Corleone in The Godfather. He is James Caan, and he passed away in

July 2022.

I am reading

a Tax Court case involving his (more correctly: his estate’s) IRA.

There is a hedge

fund involved.

For the most

part, we are comfortable with “traditional” investments: money markets, CDs,

stocks, bonds, mutual funds holding stocks and bonds and the mutual fund’s

updated sibling: an ETF holding stocks and bonds.

Well, there

are also nontraditional investments: gold, real estate, cryptocurrency, private

equity, hedge funds. I get it: one is seeking additional diversification, low

correlation to existing investments, enhanced protection against inflation and

so forth.

For the most

part, I consider nontraditional investments as more appropriate for wealthier

individuals. Most people I know have not accumulated sufficient wealth to need nontraditional

assets.

There are

also tax traps with nontraditional assets in an IRA. We’ve talked before about

gold. This time let’s talk about hedge funds.

James Caan

had his cousin (Paul Caan) manage two IRAs at Credit Suisse. Paul wanted to

take his career in a different direction, and he transferred management of the

IRAs to Michael Margiotta. Margiotta left Credit Suisse in 2004, eventually

winding up at UBS.

The wealthy

are not like us. Caan, for example, utilized Philpott, Bills, Stoll and Meeks

(PBSM) as his business manager. PBSM would:

· Receive all Caan’s mail

· Pay his bills

· Send correspondence

· Prepare his tax returns

· Act as liaison with his financial

advisors, attorneys, and accountants

I wish.

Caan had 2

IRAs at UBS. One was a regular, traditional, Mayberry-style IRA.

The second

one owned a hedge fund.

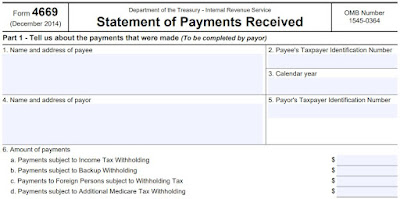

The tax Code

requires the IRA trustee or custodian to file reports every year. You probably

have seen them: how much you contributed over the last year, or the balance in

the IRA at year-end. Innocuous enough, except possibly for that year-end thing.

Think nontraditional asset. How do you put a value on it? It depends, I suppose.

It is easy enough to look up the price of gold. What if the asset is trickier:

undeveloped land outside Huntsville, Alabama – or a hedge fund?

UBS had Caan

sign an agreement for the IRA and its hedge fund.

The Client must

furnish to the Custodian in writing the fair market value of each Investment

annually by the 15th day of each January, valued as of the preceding December

31st, and within twenty days of any other written request from the Custodian,

valued as of the date specified in such request. The Client acknowledges,

understands and agrees that a statement that the fair market value is

undeterminable, or that cost basis should be used is not acceptable and the

Client agrees that the fair market value furnished to the Custodian will be

obtained from the issuer of the Investment (which includes the general partner

or managing member thereof). The Client acknowledges, understands and agrees

that if the issuer is unable or unwilling to provide a fair market value, the

Client shall obtain the fair market value from an independent, qualified

appraiser and the valuation shall be furnished on the letterhead of the person

providing the valuation.

Got it. You

have to provide a number by January 15 following year-end. If it is a hassle,

you have to obtain (and you pay for) an appraisal.

What if you

don’t?

The Client

acknowledges, understands and agrees that the Custodian shall rely upon the

Client’s continuing attention, and timely performance, of this responsibility.

The Client acknowledges, understands and agrees that if the Custodian does not

receive a fair market value as of the preceding December 31, the Custodian

shall distribute the Investment to the Client and issue an IRS Form 1099–R for

the last available value of the Investment.

Isn’t that a

peach? Hassle UBS and they will distribute the IRA and send you a 1099-R.

Unless that IRA is rolled over correctly, that “distribution” is going to cost

you “taxes.”

Let’s start

the calendar.

|

March 2015

|

|

UBS contacted the hedge

fund for a value.

|

|

June 2015

|

|

Margiotta left UBS for

Merrill Lynch.

|

|

August 2015

|

|

Striking out, UBS

contacted PBSM for a value.

|

|

October 2015

|

|

Hearing nothing, UBS

sent PBSM a letter saying UBS was going to resign as IRA custodian in

November.

|

|

October 2015

|

|

Margiotta had Caan sign

paperwork to transfer the IRAs from UBS to Merrill Lynch.

|

|

|

There was a problem: all

the assets were transferred except for the hedge fund.

|

|

December 2015

|

|

UBS sent PBSM a letter

saying that it had distributed the hedge fund to Caan.

|

|

January 2016

|

|

UBS sent a 1099-R.

|

|

March 2016

|

|

Caan’s accountant at

PBSM sent an e-mail to Merrill Lynch asking why the hedge fund still showed

UBS as custodian.

|

|

December 2016

|

|

Margiotta requested the

hedge fund liquidate the investment and send the cash to Merrill Lynch.

|

|

November 2017

|

The IRS sent the

computer matching letter wanting tax on the IRA distribution. How did the IRS

know about it? Because UBS sent that 1099-R.

|

The IRS wanted taxes of almost $780 grand, with penalties

over $155 grand.

That caught

everyone’s attention.

|

July 2018

|

|

Caan requested a private

letter ruling from the IRS.

|

Caan wanted

mitigation from an IRA rollover that went awry. This would be a moment for PBSM

(or Merrill) to throw itself under the bus: taxpayer relied on us as experts to

execute the transaction and was materially injured by our error or negligence….

That is not

wanted they requested, though. They requested a waiver of the 60-day

requirement for rollover of an IRA distribution.

I get it:

accept that UBS correctly issued a 1099 for the distribution but argue that fairness

required additional time to transfer the money to Merrill Lynch.

There is a

gigantic technical issue, though.

Before that,

I have a question: where was PBSM during this timeline? Caan was paying them to

open and respond to his mail, including hiring and coordinating experts as

needed. Somebody did a lousy job.

The Court

wondered the same thing.

Both

Margiotta and the PBSM accountant argued they never saw the letters from UBS

until litigation started. Neither had known about UBS making a distribution.

Here is the

Court:

We do not find that portion of either witness’ testimony

credible.

Explain,

please.

We find it highly unlikely that PBSM

received all mail from UBS— statements, the Form 1099–R, and other

correspondence—except for the key letters (which were addressed to PBSM).

Additionally, the March 2016 email between Ms. Cohn and Mr. Margiotta suggests

that both of them knew of UBS’s representations that it had distributed the

P&A Interest. It seems far more likely that there was simply a lack of

communication and coordination between the professionals overseeing Mr. Caan’s

affairs, especially given the timing of UBS’s letters, Mr. Margiotta’s move

from UBS to Merrill Lynch, and the emails between Mr. Margiotta and Ms. Cohn.

If all parties believed that UBS was still the P&A Interest’s custodian,

why did no one follow up with UBS when it ceased to mail account statements for

the IRAs? And why, if everyone was indeed blindsided by the Form 1099–R, did no

one promptly follow up with UBS regarding it? (That followup did not occur

until after the IRS issued its Form CP2000.) The Estate has offered no satisfactory

explanation to fill these holes in its theory.

I agree with

the Court.

I think that

PBSM and/or Merrill Lynch should have thrown themselves under the bus.

But I would

probably still have lost. Why? Look at this word salad:

408(d) Tax

treatment of distributions.

(3) Rollover

contribution.

An

amount is described in this paragraph as a rollover contribution if it meets

the requirements of subparagraphs (A) and (B).

(A) In general.

Paragraph (1) does not apply to any amount paid or distributed out of an

individual retirement account or individual retirement annuity to the

individual for whose benefit the account or annuity is maintained if-

(i) the entire

amount received (including money and any other property) is paid into an

individual retirement account or individual retirement annuity (other than an

endowment contract) for the benefit of such individual not later than the 60th

day after the day on which he receives the payment or distribution; or

(ii) the entire

amount received (including money and any other property) is paid into an

eligible retirement plan for the benefit of such individual not later than the

60th day after the date on which the payment or distribution is received,

except that the maximum amount which may be paid into such plan may not exceed

the portion of the amount received which is includible in gross income

(determined without regard to this paragraph).

I

highlighted the phrase “including money and any other property.” There is a case (Lemishow)

that read a “same property” requirement into that phrase.

What does

that mean in non-gibberish?

It means

that if you took cash and property out of UBS, then the same cash and property

must go into Merrill Lynch.

Isn’t that

what happened?

No.

What came

out of UBS?

Well, one

thing was that hedge fund that caused this ruckus. UBS said it distributed the

hedge fund to Caan. They even issued him a 1099-R for it.

What went

into Merrill Lynch?

Margiotta

requested the hedge fund sell the investment and send the cash to Merrill

Lynch.

Cash went

into Merrill Lynch.

What went

out was not the same as what went in.

Caan (his

estate, actually) was taxable on the hedge fund coming out of the UBS IRA.

Dumb.

Unnecessary. Expensive.

Our case

this time was Estate of James E. Caan v Commissioner, 161 T.C. No. 6,

filed October 18, 2023.