The last time I checked, IRS Appeals personnel count was down by approximately 20% and – no surprise – getting a case through Appeals is taking over a year.

There is danger – and potentially an immediate one – to

taxpayers and tax advisors.

Take a look at this cheerful composition:

26 U.S. Code § 6532 - Periods of limitation on suits

(1) General rule

No suit or proceeding under section 7422(a) for the recovery of any internal revenue tax, penalty, or other sum, shall be begun before the expiration of 6 months from the date of filing the claim required under such section unless the Secretary renders a decision thereon within that time, nor after the expiration of 2 years from the date of mailing by certified mail or registered mail by the Secretary to the taxpayer of a notice of the disallowance of the part of the claim to which the suit or proceeding relates.

(2) Extension of time

The 2-year period prescribed in paragraph (1) shall be extended for such period as may be agreed upon in writing between the taxpayer and the Secretary.

(3) Waiver of notice of disallowance

If any person files a written waiver of the requirement that he be mailed a notice of disallowance, the 2-year period prescribed in paragraph (1) shall begin on the date such waiver is filed.

(4) Reconsideration after mailing of notice

Any consideration, reconsideration, or action by the Secretary with respect to such claim following the mailing of a notice by certified mail or registered mail of disallowance shall not operate to extend the period within which suit may be begun.

We see the following:

The IRS has 6

months to respond to a claim for refund. If no response is forthcoming within

that time, the taxpayer can sue for refund, as long as the suit or proceeding occurs

within the two-year period beginning with the date the IRS formally disallowed the

claim.

What if the IRS never responds to

the claim? Your tax advisor (CPA or attorney) will likely recommend you file

suit within 2 years from filing the claim. If you file, a tax CPA will hand

you off to a tax attorney. A tax CPA can do a lot, but one must be a member of

the bar to litigate.

What happens if you miss the Section

6532 deadline?

Let’s look at this next artful

arrangement:

26 U.S. Code § 6514 - Credits or refunds after period of limitation

(a) Credits or refunds after period of limitation

A refund of any portion of an internal revenue tax shall be considered erroneous and a credit of any such portion shall be considered void—

(1) Expiration of period for filing claim

If made after the expiration of the period of limitation for filing claim therefor, unless within such period claim was filed; or

(2) Disallowance of claim and expiration of period for filing suit

In the case of a claim filed within the proper time and disallowed by the Secretary, if the credit or refund was made after the expiration of the period of limitation for filing suit, unless within such period suit was begun by the taxpayer.

(3) Recovery of erroneous refunds

For procedure by the United States to recover erroneous refunds, see sections 6532(b) and 7405.

(b) Credit after period of limitation

Any credit against a liability in respect of any taxable year shall be void if any payment in respect of such liability would be considered an overpayment under section 6401(a).

Section 6514(a)(2) can be brutal: the IRS is

prohibited from issuing the refund unless within such period suit was

begun by the taxpayer.

Oh, this is all big corporate tax stuff, you say. Unless

your name is Apple or Nvidia, can this ever reach you?

Yepper.

What if you filed for an ERC (employee retention

credit) and (1) have never heard back from the IRS or (2) did hear back but the

IRS disallowed the claim? The IRS has been using Letter 105C (if they disallowed

the ERC claim in full) or Letter 106C (if they partially disallowed the claim).

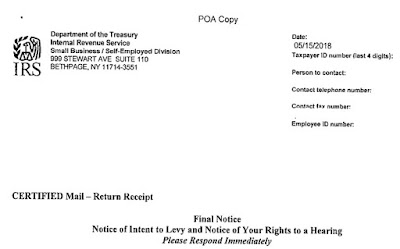

A 105C letter will include language like this:

There is the disallowance language that Sections 6532

and 6514 allude to.

When was the IRS sending out these letters?

After running ERC claims through a risk-scoring algorithm,

the IRS sent out approximately 28,000 letters 105C and 106C during the summer

of 2024. If the taxpayer responded (to the 105C or 106C), the IRS would then conduct

an mini-audit before sending the file to Appeals.

2024 plus 2 years equals 2026 – your two-year statute

of limitations is coming up.

Is there a way to avoid filing in Court but still

preserve your rights to a refund?

Yes. Let’s go back to Section 6532(a)(2).

There is a form that goes with it.

Here is the Internal Revenue Manual on Form 907:

On first impression, I like the Form 907 option. What more

do we need to know about it?

(1)

First,

you are still within Section 6532, so this must be done within the 2-year

window.

(2)

Both

parties – you and the IRS – must sign Form 907.

(3)

If

the case is being actively worked, the Revenue Agent or Appeals Officer can hopefully

help obtain the appropriate IRS signature.

But what if the case is not being actively worked?

There are several ways this can happen:

·

The file is lost (I had one lost in IRS

Kansas City a few years ago; it held up a real estate closing).

·

You are waiting for the protest to be

transferred to Appeals.

·

The protest has been transferred to

Appeals but remains unassigned.

·

The protest was transferred and assigned but

your AO is no longer working at the IRS. It again is … unassigned.

·

You never even filed a protest to either

Letter 105C or 106C.

The IRS considers Form 907 to be an internal form, to

be initiated by IRS employees. If you have settled on Form 907 and your back is

to the wall on obtaining an IRS signature, consider the Taxpayer Advocate.

But give yourself breathing room. I suspect that

trying to obtain an IRS signature on short notice – whether actively worked or

not, assigned or unassigned – will prove futile.

You might have to file suit to preserve the claim.