It is a famous case. It is also an example of different Collection rules not playing well together.

We find Kathleen Vinatieri and the IRS in Tax Court.

Life had been unkind to Kathleen:

I don’t know what you want to know cause I do not understand all the legal stuff you sent me. I can’t afford a lawyer. And the closest legal aid is in Knoxville 30 miles away. My poor car will not go that far.”

The IRS was chasing her 2002 federal taxes.

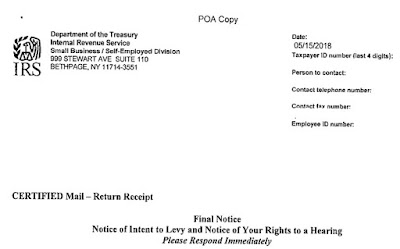

She requested a Collection hearing.

When the Settlement Officer (SO) asked Kathleen whether she wanted a payment plan, she replied that she could not pay. She had $14 in the bank; a 1996 Toyota with 243,000 miles and worth $300; she had pulmonary fibrosis; was dying; and was taking care of kids.

COMMENT: This is a sad case to read and extremely unflattering to the IRS. It should have drawn an immediate currently not collectible (CNC) status.

The SO agreed on CNC status, but there was a problem: The Internal Revenue Manual (IRM) required one to have filed all tax returns before obtaining CNC status. Kathleen had not filed 2005. She had tried, but the payroll company that (was supposed to) issue her a W-2 had gone out of business. She had previously contacted the IRS for a transcript, but the IRS had no information on that W-2 either.

You can see the issue. Unless Kathleen had retained that last 2005 pay stub, there was no way for her to file that tax return. The IRS could not help, as they did not have a copy of the W-2 either. Kathleen was stranded.

BTW, the IRM is internal to the IRS.

Here is the Regulation – and external to the IRS.

§ 301.6343-1 Requirement to release levy and notice of release.

(a) In general. A district director, service center director, or compliance center director (director) must promptly release a levy upon all, or part of, property or rights to property levied upon and must promptly notify the person upon whom the levy was made of such a release, if the director determines that any of the conditions in paragraph (b) of this section (conditions requiring release) exist. The director must make a determination whether any of the conditions requiring release exist if a taxpayer submits a request for release of levy in accordance with paragraph (c) or (d) of this section; however, the director may make this determination based upon information received from a source other than the taxpayer. The director may require any supporting documentation as is reasonably necessary to determine whether a condition requiring release exists.

(b) Conditions requiring release. The director must release the levy upon all or a part of the property or rights to property levied upon if he or she determines that one of the following conditions exists—

(1) Liability satisfied or unenforceable

(2) Release will facilitate collection.

(3) Installment agreement.

(4) Economic hardship—(i) General rule. The levy is creating an economic hardship due to the financial condition of an individual taxpayer. This condition applies if satisfaction of the levy in whole or in part will cause an individual taxpayer to be unable to pay his or her reasonable basic living expenses. The determination of a reasonable amount for basic living expenses will be made by the director and will vary according to the unique circumstances of the individual taxpayer. Unique circumstances, however, do not include the maintenance of an affluent or luxurious standard of living.

The Regulation requires the IRS to release a levy in the event of economic hardship. There was no question that Kathleen was in economic hardship. It seems absurd to issue a levy under the IRM to only have it stayed by a Regulation – that is, if Kathleen had the staying power to continue her fight against IRS Collections.

Which one overrides: the IRM or the Regulation?

The Tax Court decided:

A determination in a hardship case to proceed with a levy that must immediately be released is unreasonable and undermines public confidence that tax laws are being administered fairly.”

Well, fairly and sanely, I would add.

In a section 6330 pre-levy hearing, if the taxpayer has provided information that establishes the proposed levy will create economic hardship, the settlement officer cannot go forward with the levy and must consider an alternative.”

The Regulations to the Code take precedence over an internal IRS publication. The IRS cannot itself cause economic hardship when pursuing a levy. It took time and treasure, but the Court eventually got to the correct result.

I note that the reason for nonfiling was likely important. In this case the payroll company had gone out of business, and even the IRS did not have a copy of the W-2. Consequently, neither the Settlement Officer nor the Tax Court questioned whether Kathleen was acting in good faith. Substitute a taxpayer who simply refused to file – an extreme example would be a protestor – and I doubt the result would be the same.

Our case this time was Vinatieri v Commissioner, 133 T.C. 392 (2009).