You may have heard that Congress is tightening the 1099 reporting requirements for third party payment entities such as PayPal and Venmo. The ultimate goal is to report cumulative payments exceeding $600. Because of implementation issues, the IRS has adjusted this threshold to $5,000 for 2024.

Many, I suspect, will be caught by surprise.

Receiving a 1099-K does not necessarily mean that you have taxable income. It does mean that you were paid by one of the reporting organizations, and that payment will be presumed business-related. This is of concern with Venmo, for example, as a common use is payment of group-incurred personal expenses, such as the cost of dining out. Venmo will request one to identify a transaction as business or personal, using that as the criterion for IRS reporting

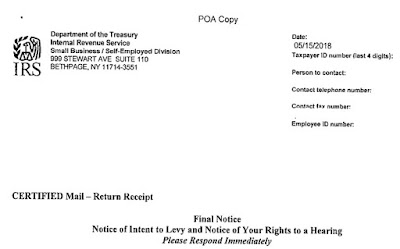

What you cannot do, however, is ignore the matter. This IRS matching is wholly computerized; the notice does not pass by human eyes before being mailed. In fact, the first time the IRS reviews the notice is when you (or your tax preparer) respond to it. Ignore the notice however and you may wind up in Collections, wondering what happened.

The IRS adjusted the 2004 and 2005 returns for Andrea Orellana.

The IRS had spotted unreported income from eBay. Orellana had reported no eBay sales, so the computer match was easy.

There was a problem, though: Orellana worked for the IRS as a revenue officer.

COMMENT: A revenue officer is primarily concerned with Collections. A revenue agent, on the other hand, is the person who audits you.

Someone working at the IRS is expected to know and comply with his/her tax reporting obligations. As a revenue officer, she should have known about 1099-Ks and computer matching.

It started as a criminal tax investigation.

Way to give the benefit of the doubt there, IRS.

There were issues with identifying the cost of the items sold, so the criminal case was closed and a civil case opened in its place.

The agent requested and obtained copies of bank statements and some PayPal records. A best guess analysis indicated that over $36 thousand had been omitted over the two years.

Orellana was having none of this. She requested that the case be forwarded to Appeals.

Orellana hired an attorney. She was advised to document as many expenses as possible. The IRS meanwhile subpoenaed PayPal for relevant records.

Orellana did prepare a summary of expenses. She did not include much in the way of documentation, however.

The agent meanwhile was matching records from PayPal to her bank deposits. This proved an unexpected challenge, as there were numerous duplicates and Orellana had multiple accounts under different names with PayPal.

The agent also needed Orellana’s help with the expenses. She was selling dresses and shoes and makeup and the like. It was difficult to identify which purchases were for personal use and which were for sale on eBay.

Orellana walked out of the meeting with the agent.

COMMENT: I would think this a fireable offense if one works for the IRS.

This placed the agent in a tough spot. Without Orellana’s assistance, the best she could do was assume that all purchases were for personal use.

Off they went to Tax Court.

Orellana introduced a chart of deposits under dispute. She did not try to trace deposits to specific bank accounts nor did she try to explain – with one exception - why certain deposits were nontaxable.

Her chart of expenses was no better. She explained that any documents she used to prepare the chart had been lost.

Orellana maintained that she was not in business and that any eBay activity was akin to a garage sale. No one makes a “profit” from a garage sale, as nothing is sold for more than its purchase price.

The IRS pointed out that many items she bought were marketed as “new." Some still had tags attached.

Orellana explained that she liked to shop. In addition, she had health issues affecting her weight, so she always had stuff to sell.

As for “new”: just a marketing gimmick, she explained.

I always advertise as new only because you can get a better price for that.”

… I document them as new if it appears new.”

Alright then.

If she can show that there was no profit, then there is no tax due.

Orellana submitted records of purchases from PayPal.

… but they could not be connected or traced to her.

She used a PayPal debit card.

The agent worked with that. She separated charges between those clearly business and those clearly personal. She requested Orellana’s help for those in between. We already know how that turned out.

How about receipts?

She testified that she purchased personal items and never kept receipts.

That would be ridiculous, unheard of. Unless there was some really bizarre reason why I keep a receipt, there were no receipts.”

The IRS spotted her expenses that were clearly business. They were not enough to create a loss. Orellana had unreported income.

And the Court wanted to know why an IRS Revenue Officer would have unreported income.

Frankly, so would I.

Petitioner testified that she ‘had prepared 1040s since she was 16’ and that she ‘would ‘never look at the instructions.’”

Good grief.

The IRS also asked for an accuracy penalty.

The Court agreed.

Our case this time was Orellana v Commissioner, T.C. Summary Opinion 2010-51.