I have gotten dragged into a rabbit hole.

I often get involved with clients on a one-off basis:

they are buying a company, selling their business, expanding into other states,

looking into oddball tax credits and so forth. Several of our clients have been

selling their businesses. In some cases, they have been offered crazy money by a

roll-up; in others it is the call of retirement. I was looking at the sale of a

liquor store last fall. As business sales go, it was not remarkable. The owner

is 75 years old and has been working there since he was a teenager. It was time.

The sale happened this year.

Fast forward to a few weeks ago. The CPA who works

with the liquor store was taking time off, but I was in the office. The owner

remembered me.

“Can I see you this afternoon,” he asked.

“Of course. Let me know what works for you.”

He brought an IRS notice of appointment with a field

revenue officer. I reviewed the notice: there was a payroll issue as well as an

issue with the annual deposit to retain a fiscal year.

I had an educated guess about the annual deposit. This

filing is required when a passthrough (think partnership or S corporation) has

a year-end other than December. We do not see many of these, as passthroughs

have mostly moved to calendar year-ends since the mid-eighties. The deposit is

a paper-file, and clients have become so used to electronic filing they

sometimes forget that some returns must still be filed via snail mail.

The payroll tax issue was more subtle. For some

reason, the IRS had not posted a deposit for quarter 4, 2022. This set a

penalty cascade into motion, as the IRS will unilaterally reorder subsequent

tax deposits. Let this reordering go on for a couple of quarters or more and

getting the matter corrected can border on a herculean task.

I spoke with the revenue officer. She sounded very

much like a new hire. Her manager was on the call with her. Yep, new hire.

Let’s start the routine:

“Your client owes a [fill in the blank] dollars. Can

they pay that today?”

“I disagree they owe that money. I suspect it is much

less, if they owe at all.”

“I see. Why do you say that?”

I gave my spiel.

“I see. Once again, do you want to make payment

arrangements?”

I have been through this many times, but it still

tests my patience.

“No, I will recap the liabilities and deposits for the

two quarters under discussion to assist your review. Once you credit the

suspended payroll deposit to Q4, you will see the numbers fall into place.”

“What about the 8752 (the deposit for the non-calendar

year-end)?

“I have record that it was prepared and provided to

the taxpayer. Was it not filed?”

“I am not seeing one filed.”

“These forms are daft, as they are filed in May

following the fiscal year in question. Let’s be precise which fiscal year is at

issue, and I will send you a copy. Do you want it signed?”

The manager chimes in: that is incorrect. Those forms

are due in December.”

Sigh.

New hire, poorly trained manager. Got it.

I ask for time to reply. I assemble documents, draft a

walkthrough narration, and fax it to the field revenue officer. I figure we

have one more call. Maybe the client owes a couple of bucks because … of course,

but we should be close.

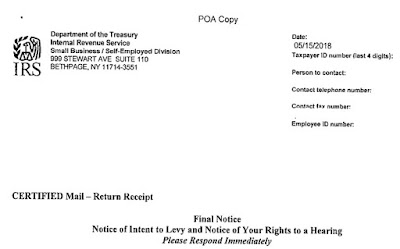

Then I received the following:

I am not amused.

The IRS has misstepped. They escalated what did not

need to escalate, costing me additional time and the client additional professional

fees. Here is something not included when discussing additional IRS funding for

new hires: who is going to train the new hires? The brain drain at the IRS over

the last decade and a half has been brutal. It is debatable whether there remains

a deep enough lineup to properly train new hires in the numbers and time frame

being presented. What is realistic – half as many? Twice as long? Bring people

out of retirement to help with the training?

Mind you, I am pulling for the IRS. The better they do

their job the easier my job becomes. That said, there are realities. CPA firms

cannot find qualified hires in adequate numbers, and the situation does not

change by substituting one set of letters (fill-in whatever word-salad firm name

you want) for another (IRS). Money is an issue, of course, but money is not the

only issue. There are enormous societal changes at work.

What is our next procedural move?

I requested a CDP hearing.

The Collections Due Process hearing is a breather as

the IRS revs its Collections engines. It allows one to present alternatives to

default Collections, such as:

· An

offer in compromise

· An

installment agreement

I have no intention of presenting Collections

alternatives. If we owe a few dollars, I will ask the client to write a check

to the IRS. No, what I want is the right to dispute the amount of tax liability.

A liability still under examination by a field revenue

officer. I have agreed to nothing. I have not even had a follow-up phone call. A

word to the new hires: it is considered best practice – and courteous - to not surprise

the tax practitioner. A little social skill goes a long way.

The Notice of Intent to Levy was premature.

Someone was not properly trained.

Or supervised.

I question whether this would have happened 15 or more

years ago.

But then again, 15 years from now the new hires will be

the institutional memory at the IRS.

It is the years in between that are problematic.

No comments:

Post a Comment