Is not.

For decades, social security benefits were not taxable at all.

This changed with the Social Security Amendment of 1983, with the intent to shore up the social security trust fund. Beginning in 1984, if one’s income exceeded certain stairsteps ($25,000 for singles and $32,000 for marrieds), then benefits could be up to 50% taxable.

Flip the calendar and The Omnibus Budget Reconciliation Act of 1993 raised the taxable portion up to 85% and added two more stairsteps ($34,000 for singles and $44,000 for marrieds).

COMMENT: The taxation of social security is Congressional pratfall. There are two separate calculations here. The first calculation starts taxing benefits at $25,000 (for singles; $32,000 for marrieds) up to 50 percent. If your income keeps going, then you hit the second stairstep ($34,000 for singles; $44,000 for marrieds) up to 85%. Fall in between these two phaseout zones and you may want to use software to prepare your return.

COMMENT: BTW, Congress has never inflation-adjusted those 1984 or 1993 dollars.

No tax on social security became a political slogan during the presidential election. I have heard the phrase repeated since then, but it is not accurate.

It would be more accurate to describe it as an age-based deduction.

Take a look at the tax provision in its feral state:

SEC. 70103. TERMINATION OF DEDUCTION FOR PERSONAL EXEMPTIONS OTHER THAN TEMPORARY SENIOR DEDUCTION

(a)(3)(C) Deduction for seniors

(i) In general.—In the case of a taxable year beginning before January 1, 2029, there shall be allowed a deduction in an amount equal to $6,000 for each qualified individual with respect to the taxpayer.

(ii) Qualified individual.—For purposes of clause (i), the term ‘qualified individual’ means—

(I) the taxpayer, if the taxpayer has attained age 65 before the close of the taxable year, and

(II) in the case of a joint return, the taxpayer’s spouse, if such spouse has attained age 65 before the close of the taxable year.

(iii) Limitation based on modified adjusted gross income.

(I) In general.—In the case of any taxpayer for any taxable year, the $6,000 amount in clause (i) shall be reduced (but not below zero) by 6 percent of so much of the taxpayer’s modified adjusted gross income as exceeds $75,000 ($150,000 in the case of a joint return).

(II) (II) Modified adjusted gross income.—For purposes of this clause, the term ‘modified adjusted gross income’ means the adjusted gross income of the taxpayer for the taxable year increased by any amount excluded from gross income under section 911, 931, or 933.

(iv) Social security number required.

(I) In general.—Clause (i) shall not apply with respect to a qualified individual unless the taxpayer includes such qualified individual’s social security number on the return of tax for the taxable year.

(II) Social security number.—For purposes of subclause (I), the term ‘social security number’ has the meaning given such term in section 24(h)(7).

(v) Married individuals.—If the taxpayer is a married individual (within the meaning of section 139, this subparagraph shall apply only if the taxpayer and the taxpayer’s spouse file a joint return for the taxable year.”

What do I see?

- There is no mention of social security benefits.

- There is no mention, in fact, of retirement income at all.

- You do have to be at least age 65 to qualify.

- The deduction is (up to) $6,000 per qualifying individual.

- Make too much money ($75,000 for singles and $150,000 for marrieds) and you start losing the deduction. The deduction phases-out completely at $150,000 (singles) and $250,000 (marrieds).

- If you are married, you must file jointly. Married filing separately will not work here.

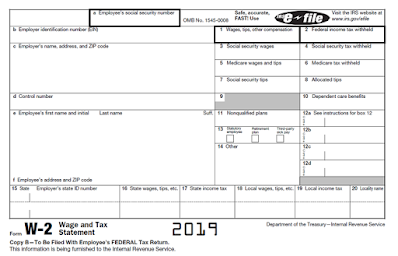

- The only mention of social security is that one must include one’s social security number on the tax return, otherwise the IRS will consider it a math error and send you a bill for taxes due.

What do I not see?

- No tax on social security.

I get it: for many if not most people, social security benefits would not have been taxable anyway because of the stairsteps, the increased standard deduction and the additional standard deduction for taxpayers age 65 and over. I would prefer that we use the English language with more precision, but such is not our fate.

We didn’t even mention the insolvency of the social security system itself.

Take advantage if you can, as the deduction has a shelf life of only four years. Granted, a future Congress can extend (and re-extend) this deduction ad infinitum, but I suspect that will not happen here.