I am reading

a case involving a late tax return, a Ponzi scheme, and an IRS push for

penalties.

It made me

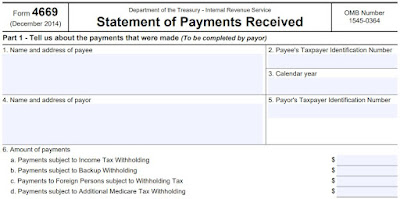

think of this form:

It is used for one of two reasons:

(1) Someone is filing a tax return with

numbers different from a Schedule K-1 received from a passthrough entity (such

as a partnership).

(2) Someone is amending a TEFRA

partnership return.

That second one is a discussion for another day. Let’s focus

instead on the first reason. How could it happen?

Easy. You are a partner in a partnership. You bring me your

Schedule K-1 to prepare your personal return. I spot something wrong with the

K-1, and the numbers are large enough to matter. We contact that partnership to

amend the return and/or your K-1. The partnership refuses.

COMMENT: We would use Form 8082 to inform the IRS that we are not using numbers provided on your K-1.

This is a tough spot to be in. File the form and you are possibly

waiving a flag at the IRS. Fail to file it and the IRS has procedural rights,

and those include the right to change your numbers back to the original (and disputed)

K-1.

There is another situation where you may want to file Form 8082.

Let’s look at the Rosselli case.

Mr. Roselli (Mr. R) was a housing appraiser. Mrs. Rosselli was

primarily a homemaker. Together they have five children, three of whom have

special needs.

Through his business, Mr. R came to know the founder of a

solar energy company (DC Solar). Turns out that DC Solar was looking for

additional capital, and Mr. R knew someone looking to invest. The two were

introduced and – in gratitude – Mr R became a managing member in DC Solar via his company Halo Management Services LLC.

This part turned out well for the R’s. In 2017 DC Solar paid

Halo approximately $300 grand. In 2018 DC Solar paid approximately $414 grand.

Considering they had no money invested, this was all gravy for the R's.

COMMENT: Notice that Halo was paid for management services. Halo in turn was Mr. R, so Mr. R got paid over $700 grand over two years for services performed. This was a business, and Mr. R needed to report it on his tax return like any other business.

In late 2018 the FBI raided DC Solar’s offices investigating

whether the company was a Ponzi scheme. The owners of DC Solar were eventually

indicted and pled guilty, so I guess the company was.

Let’s roll into the next year. It was tax time (April 15, 2019) and

there was not a K-1 from DC Solar in sight.

COMMENT: You think?

The accountant filed an extension until October 15. It did

not matter, as the R’s did not file a tax return by then either.

The IRS ran a routine check on DC Solar and its partners. It

did not take much for the IRS to flag that the R’s had not filed a 2018 return.

The IRS contacted the R’s, who contacted their accountant, eventually filing their

2018 return in January 2022.

You know what was on that 2018 return? The $414 grand in management

fees.

You know what was not on that 2018 return? A big loss from DC

Solar.

Here is Mr. R:

Mr. Carpoff informed me that I was to receive Schedule K-1s showing large ordinary losses for 2018 from DC Solar, and as a result I would not have a tax liability for that year. However, before the K-1s could be issued … DC Solar’s offices were raided by the FBI.”

All of DC Solar’s documents and records were seized by federal authorities in the ensuing investigation. As a result, I was unable to determine any tax implications because I did not receive a K-1 or any other tax reporting information from DC Solar.”

Got it: Mr. R was expecting a big loss to go with that $414

grand. And why not? DC Solar had reported a big loss to him for 2017, the prior

year.

But the IRS Collections machinery had started turning. By August

2022, the IRS was moving to levy, and the R’s filed for a Collection Due

Process (CDP) hearing.

COMMENT: There is maddening procedure about arguing underlying tax liability in a CDP hearing, which details we will skip. Suffice to say, a taxpayer generally wants to fight any proposed tax liability like the third monkey boarding Noah’s ark BEFORE requesting a CDP hearing.

At the conclusion of the CDP hearing, the IRS decided that

they had performed all the required procedural steps to collect the R’s 2018

tax. The R’s disagreed and filed with the Tax Court.

The R’s presented three arguments.

- They reasonably assumed that they would not be required to file or pay tax for 2018 because of an expected loss from the DC Solar K-1.

The Court was not buying this. Not owing any taxes is not the same as not being required to file. This was not a case where someone did not work, meaning they dd not have enough income to trigger a filing requirement. The Rs instead had a more complicated return, with income here and deductions or losses there. Granted, it might compress to no tax due, but they needed to file so one could follow how they got to that answer.

- The R’s reasonably relied on advice from their accountant and others.

The Court did not buy this either. For one thing, the Rs had never informed their accountant about the $414 grand in management fees. If one wants to rely on a professional’s advice, one must provide all available pertinent information to the professional. The Court was not amused that the R’s had not shared the LARGEST number on their return with their accountant.

- The R’s argued that they would experience “undue hardship” from paying the tax on its due date.

The R’s argued that their income died up when DC Solar was raided. Beyond that, though, they had not provided further information on what “drying up” meant. Without information about their assets, liabilities and remaining sources of income, the Court found the R’s argument to be self-serving.

Also, the Court did not ask – but I will – what the R's had

done with the $700 grand in management fees they received in 2017 and 2018.

Yeah, no. The Court found for the IRS, penalties and all.

And here is what I am thinking:

What if they had timely filed their 2018 return, showing a loss from DC Solar equal to the management fees?

Problem: there was no K-1 from DC Solar.

Answer: attach the 8082.

I think the tax would eventually have turned

out the same.

But I also think they would have had a persuasive case for

abatement of penalties for late filing and late payment. The penalty for late

file and pay is easily 25%, so that abatement is meaningful.

Our case this time was Rosselli v Commissioner, TC

Bench Opinion, October 23, 2023.