Steve Hamilton is a Tampa native and a graduate of the University of South Florida and the University of Missouri. He now lives in northern Kentucky. A career CPA, Steve has extensive experience involving all aspects of tax practice, including sophisticated income tax planning and handling of tax controversy matters for closely-held businesses and high-income individuals.

Monday, December 25, 2023

Saturday, December 23, 2023

Notice(s) Of Intent To Seize And Levy

I received the following notice under power of attorney for a client.

Another

accountant at Galactic Command works with the client. I am the tax nerd should problems

arise.

Yeah, we

have a problem.

For more

than one year, too.

Combine the

two and I can get cranky. Just because I know the route doesn’t mean I want to revisit

the site.

But back to

our topic.

The notice

seems terrifying, doesn’t it? The IRS is talking about seizing and levying and

all matters of unkindliness.

Let’s go

through the sequence of these notices.

First, you owe the IRS. There is a sequence of four notices, sometimes referred to as the “500” sequence.

- CP501 You have unpaid taxes somewhere.

- CP502 We have not heard from you about unpaid taxes.

- CP503 Hey, dummy! Are you there?

- CP504 We intend to levy if you do not do something.

This is the

fourth notice in the sequence for our client for tax year 2022. As you can see,

he/she/they are moving through the IRS machinery rather quickly. Then again,

almost $225,000 in taxes and penalties buys you a better spot in line.

The CP504 is

however not the final:final notice.

Let’s talk

IRS procedure.

Before the

IRS can go after your stuff (bank account, car, John Cena collectibles), it must

(almost always) allow you a hearing. This is called a Collection Due Process

(CDP) hearing, and it entered the tax Code with the 1998 IRS Restructuring and

Reform Act. The Act was Congress’ response to IRS horror stories, including aggressive

collection actions.

The IRS is

not allowed to go after you until you have been offered that CDP hearing. You

can turn it down, blow it off or whatever, but the IRS must provide the

opportunity before it can unleash the tender attention of Collections.

Except …

There is a short list of stuff the IRS can levy before a CDP. The list is uncommon air, except for:

Your state tax refund

That’s it.

For most of us, the IRS can only go after our state tax refund – at this stage.

Then you

have the FINAL BIG BAD notice: either the 1058 or LT11.The difference depends

on whether you have been assigned to a Revenue Officer (RO).

LIFE TIP: Avoid having your own Revenue Officer.

If you get to a 1058 or LT11, you are at the end of the line. You will be dealing with Collections, and it is unlikely you will like the experience.

You may want

an attorney or CPA, depending upon.

Not that having

a CPA seems to matter – because clearly not - to our client.

Sunday, December 17, 2023

90 Days Means 90 Days

Let’s return to an IRS notice we have discussed in the past: the 90-Day letter or Notice of Deficiency. It is commonly referred to as a “NOD” or “SNOD.”

If you get one, you are neck-deep into IRS machinery.

The IRS has already sent you a series of notices saying that you did not report

this income or pay that tax, and they now want to formally transfer the matter

to Collections. They do this by assessing the tax. Procedure however requires

them (in most cases) to issue a SNOD before they can convert a “proposed”

assessment to a “final” assessment.

It is not fun to deal with any unit or department at the

IRS, but Collections is among the least fun. Those guys do not care whether you

actually owe tax or have reasonable cause for abating a penalty. Granted, they

might work with you on a payment plan or even interrupt collection activity for

someone in severe distress, but they are unconcerned about the underlying story.

Unless you agree with the proposed IRS adjustment, you

must respond to that SNOD.

That means you are in Tax Court.

Well, sort of.

The IRS will return the case to the IRS Appeals with instructions

and the hope that both sides will work it out. The last thing the Tax Court

wants is to hear your case.

This week I finally heard from Appeals concerning a filing

back in March.

Here is a snip of the SNOD that triggered the filling.

Yeah, no. We are not getting rolled for almost $720 grand.

I mentioned above that this notice has several names,

including 90-day letter.

Take the 90 days SERIOUSLY.

Let’s look at the Nutt case.

The IRS mailed the Nutts a SNOD on April 14, 2022 for

their 2019 tax year. The 90 days were up July 18, 2022. The 18th was

a Monday, not a holiday in fantasy land or any of that. It was just a regular

day.

The Nutts lived in Alabama.

They filed their Tax Court petition electronically at

11.05 p.m.

Alabama.

Central time.

90 days.

The Tax Court is in Washington, D.C.

The Tax Court received the electronic filing at 12.05

a.m. July 19th.

Eastern time.

91 days.

The Tax Court bounced the petition. Since it had to be

filed with the Tax Court - and the Tax Court is eastern time - the 90 days had

expired.

A harsh result, but those are the rules.

Our case this time was Nutt v Commissioner, 160

T.C. No 10 (2023).

Sunday, December 10, 2023

A Ponzi Scheme And Filing Late

I am reading

a case involving a late tax return, a Ponzi scheme, and an IRS push for

penalties.

It made me

think of this form:

It is used for one of two reasons:

(1) Someone is filing a tax return with

numbers different from a Schedule K-1 received from a passthrough entity (such

as a partnership).

(2) Someone is amending a TEFRA

partnership return.

That second one is a discussion for another day. Let’s focus

instead on the first reason. How could it happen?

Easy. You are a partner in a partnership. You bring me your

Schedule K-1 to prepare your personal return. I spot something wrong with the

K-1, and the numbers are large enough to matter. We contact that partnership to

amend the return and/or your K-1. The partnership refuses.

COMMENT: We would use Form 8082 to inform the IRS that we are not using numbers provided on your K-1.

This is a tough spot to be in. File the form and you are possibly

waiving a flag at the IRS. Fail to file it and the IRS has procedural rights,

and those include the right to change your numbers back to the original (and disputed)

K-1.

There is another situation where you may want to file Form 8082.

Let’s look at the Rosselli case.

Mr. Roselli (Mr. R) was a housing appraiser. Mrs. Rosselli was

primarily a homemaker. Together they have five children, three of whom have

special needs.

Through his business, Mr. R came to know the founder of a

solar energy company (DC Solar). Turns out that DC Solar was looking for

additional capital, and Mr. R knew someone looking to invest. The two were

introduced and – in gratitude – Mr R became a managing member in DC Solar via his company Halo Management Services LLC.

This part turned out well for the R’s. In 2017 DC Solar paid

Halo approximately $300 grand. In 2018 DC Solar paid approximately $414 grand.

Considering they had no money invested, this was all gravy for the R's.

COMMENT: Notice that Halo was paid for management services. Halo in turn was Mr. R, so Mr. R got paid over $700 grand over two years for services performed. This was a business, and Mr. R needed to report it on his tax return like any other business.

In late 2018 the FBI raided DC Solar’s offices investigating

whether the company was a Ponzi scheme. The owners of DC Solar were eventually

indicted and pled guilty, so I guess the company was.

Let’s roll into the next year. It was tax time (April 15, 2019) and

there was not a K-1 from DC Solar in sight.

COMMENT: You think?

The accountant filed an extension until October 15. It did

not matter, as the R’s did not file a tax return by then either.

The IRS ran a routine check on DC Solar and its partners. It

did not take much for the IRS to flag that the R’s had not filed a 2018 return.

The IRS contacted the R’s, who contacted their accountant, eventually filing their

2018 return in January 2022.

You know what was on that 2018 return? The $414 grand in management

fees.

You know what was not on that 2018 return? A big loss from DC

Solar.

Here is Mr. R:

Mr. Carpoff informed me that I was to receive Schedule K-1s showing large ordinary losses for 2018 from DC Solar, and as a result I would not have a tax liability for that year. However, before the K-1s could be issued … DC Solar’s offices were raided by the FBI.”

All of DC Solar’s documents and records were seized by federal authorities in the ensuing investigation. As a result, I was unable to determine any tax implications because I did not receive a K-1 or any other tax reporting information from DC Solar.”

Got it: Mr. R was expecting a big loss to go with that $414

grand. And why not? DC Solar had reported a big loss to him for 2017, the prior

year.

But the IRS Collections machinery had started turning. By August

2022, the IRS was moving to levy, and the R’s filed for a Collection Due

Process (CDP) hearing.

COMMENT: There is maddening procedure about arguing underlying tax liability in a CDP hearing, which details we will skip. Suffice to say, a taxpayer generally wants to fight any proposed tax liability like the third monkey boarding Noah’s ark BEFORE requesting a CDP hearing.

At the conclusion of the CDP hearing, the IRS decided that

they had performed all the required procedural steps to collect the R’s 2018

tax. The R’s disagreed and filed with the Tax Court.

The R’s presented three arguments.

- They reasonably assumed that they would not be required to file or pay tax for 2018 because of an expected loss from the DC Solar K-1.

The Court was not buying this. Not owing any taxes is not the same as not being required to file. This was not a case where someone did not work, meaning they dd not have enough income to trigger a filing requirement. The Rs instead had a more complicated return, with income here and deductions or losses there. Granted, it might compress to no tax due, but they needed to file so one could follow how they got to that answer.

- The R’s reasonably relied on advice from their accountant and others.

The Court did not buy this either. For one thing, the Rs had never informed their accountant about the $414 grand in management fees. If one wants to rely on a professional’s advice, one must provide all available pertinent information to the professional. The Court was not amused that the R’s had not shared the LARGEST number on their return with their accountant.

- The R’s argued that they would experience “undue hardship” from paying the tax on its due date.

The R’s argued that their income died up when DC Solar was raided. Beyond that, though, they had not provided further information on what “drying up” meant. Without information about their assets, liabilities and remaining sources of income, the Court found the R’s argument to be self-serving.

Also, the Court did not ask – but I will – what the R's had

done with the $700 grand in management fees they received in 2017 and 2018.

Yeah, no. The Court found for the IRS, penalties and all.

And here is what I am thinking:

What if they had timely filed their 2018 return, showing a loss from DC Solar equal to the management fees?

Problem: there was no K-1 from DC Solar.

Answer: attach the 8082.

I think the tax would eventually have turned

out the same.

But I also think they would have had a persuasive case for

abatement of penalties for late filing and late payment. The penalty for late

file and pay is easily 25%, so that abatement is meaningful.

Our case this time was Rosselli v Commissioner, TC

Bench Opinion, October 23, 2023.

Sunday, December 3, 2023

IRS Collection Alternatives: Pay Attention To Details

I was

glancing over recent Tax Court cases when I noticed one that involved a rapper.

I’ll be

honest: I do not know who this is. I am told that he used to date Kylie Jenner.

There was something in the opinion, however, that caught my eye because it is

so common.

Michael

Stevenson filed his 2019 tax return showing federal tax liability over $2.1

million.

COMMENT: His stage name is Tyga, and the Court referred to him as “very successful.” Yep, with tax at $2.1-plus million for one year, I would say that he is very successful.

Stevenson had requested a Collection Due Process (CDP) hearing. It must have gone south, as he was now in Tax Court.

Why a CDP

hearing, though?

Stevenson

had a prior payment plan of $65 grand per month.

COMMENT: You and I could both live well on that.

His income

had gone down, and he now needed to decrease his monthly payment.

COMMENT: I have had several of these over the years. Not impossible but not easy.

The

Settlement Officer (SO) requested several things:

· Form 433-A (think the IRS equivalent

of personal financial statements)

· Copies of bank statements

· Copies of other relevant financial

documents

· Proof of current year estimated tax

payments

Standard

stuff.

The SO

wanted the information on or by November 4, 2021.

Which came

and went, but Stevenson had not submitted anything.

Strike One.

The SO was helpful,

it appeared, and extended the due date to November 19.

Still nothing.

Strike Two.

Stevenson

did send a letter to the SO on December 1.

He proposed

payments of $13,000 per month. He also included Form 433-A and copies of bank

statements and other documents.

COMMENT: Doing well. There is one more thing ….

The SO

called Stevenson’s tax representative. She had researched and learned that

Stevenson had not made estimated tax payments for the preceding nine years. She

wanted an estimated tax payment for 2021, and she wanted it now.

COMMENT: Well, yes. After nine years people stop believing you.

Stevenson

made an estimated tax payment on December 21. It was sizeable enough to cover

his first three quarters.

COMMENT: He was learning.

The SO sent

the paperwork off to a compliance unit. She requested Stevenson to continue his

estimated payments into 2022 while the file was being worked. She also

requested that he send her proof of payments.

The

compliance unit did not work the file, and in July 2022 the SO restarted the case.

She calculated a monthly payment MUCH higher than Stevenson had earlier

proposed.

COMMENT: The SO estimated Stevenson’s future gross income by averaging his 2020 and (known) 2021 income. Granted, she needed a number, but this methodology may not work well with inconsistent (or declining) income. She also estimated his expenses, using his numbers when documented and tables or other sources when not.

The SO spoke

with the tax representative, explaining her numbers and requesting any

additional information or documentation for consideration.

COMMENT: This is code for “give me something to justify getting closer to your number than mine.”

Oh, she also

wanted proof of 2022 estimated tax payments by August 22, 2022.

Yeah, you

know what happened.

Strike

Three.

So,

Stevenson was in Tax Court charging the SO with abusing her discretion by

rejecting his proposed collection alternatives.

Remember the

something that caught my eye?

It is someone

not understanding the weight the IRS gives to estimated tax payments while working

collection alternatives.

Hey, I get

it: one is seeking collection alternatives because cash is tight. Still, within

those limits, you must prioritize sending the IRS … something. I would rather

argue that my client sent all he/she could than argue that he/she could not

send anything at all.

And the

amount of tax debt can be a factor.

How much did

Stevenson owe?

$8 million.

The Court

decided against Stevenson.

Here is the

door closing:

The Commissioner has moved for summary judgement, contending that the undisputed facts establish that Mr. Stevenson was not in compliance with his estimated tax payment obligations and the settlement officer thus was justified in sustaining the notice of intent to levy.”

Our case

this time was Stevenson v Commissioner, TC Memo 2023-115.

Thursday, November 23, 2023

Saturday, November 18, 2023

Another Backup Withholding Story

We talked not

too long ago about backup withholding.

What is it?

Think Forms

1099 and you are mostly there.

The IRS

wants reporting for many types of payments, such as:

· Interest

· Dividends

· Rents

· Royalties

· Commissions and fees

· Gambling winnings

· Gig income

Reporting requires

an identification number, and the common identification number for an

individual is a social security number.

The IRS

wants to know that whoever is being paid will report the income. The payor starts

the virtuous cycle by reporting the payment to the IRS. It also means that – if

the payee does not provide the payor with an identification number - the payor

is required to withhold and remit taxes on behalf of the payee.

You want to

know how this happens … a lot?

Pay someone

in cash.

There is a

reason you are paying someone in cash, and that reason is that you probably

have no intention of reporting the payment – as a W-2, as a 1099, as anything –

to anyone.

It is all

fun and games until the IRS shows up. Then it can be crippling.

I had the following bright shiny drop into my office recently:

The client

filed the 1099 and also responded to the first IRS notice.

It could

have gone better.

That 24% is

backup withholding, and I am the tax Merlin that is supposed to “take care of”

this. Yay me.

This case was

not too bad, as it involved a single payee.

How did it

happen?

The client issued

a 1099 to someone without including a social security number. They filled-in “do

not know” or “unknown” in the box for the social security number.

Sigh.

Sometimes you

do not know what you do not know.

Here is a

question, and I am being candid: would I send in a 1099 to the IRS if I did not

have the payee’s social security number?

Oh, I understand

the ropes. I am supposed to send a 1099 if I pay someone more than $600 for the

performance of services and yada yada yada. If I don’t, I can be subject to a

failure to file penalty (likely $310). There is also a failure to provide penalty

(likely $310 again). I suppose the IRS could still go after me for the backup

withholding, but that is not a given.

Let me see: looks

like alternative one is a $620 given and alternative two is a $38,245 given.

I am not

saying, I am just saying.

Back to our

bright shiny.

What to do?

I mentioned

that the payment went to one person.

What if we

obtained an affidavit from that person attesting that they reported the payment

on their tax return? Would that get the IRS to back down?

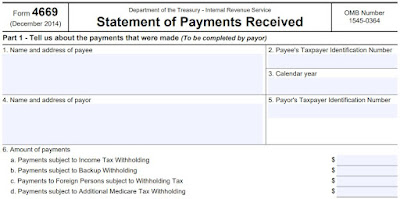

It happens enough that the IRS has a specific form for it.

We filled in

the above form and are having the client send it to the payee. We are

fortunate, as they have a continuing and friendly relationship. She will sign, date,

and return the form. We will then attach a transmittal (Form 4670) and send the

combo to the IRS. The combo is considered a penalty abatement request, and I am

expecting abatement.

Is it a

panacea?

Nope, and it

may not work in many common situations, such as:

(1) One never obtained payee contact information.

(2) A one-off transaction. One did not do

business with the payee either before or since.

(3) The payee moved, and one does not

know how to contact him/her.

(4) There are multiple payees. This could

range from a nightmare to an impossibility.

(5) The payee does not want to help, for whatever

reason.

Is there a

takeaway from this harrowing tale?

Think of

this area of tax as safe:sorry. Obtain identification numbers (think Form W-9)

before cutting someone their first check. ID numbers are not required for

corporations (such as the utility company or Verizon), but one is almost

certainly required for personal services (such as gig work). I suppose it could

get testy if the payee feels strongly about seemingly never-ending tax reporting,

but what are you supposed to do?

Better to

vent that frustration up front rather than receive a backup withholding notice

for $38,245.

And wear out

your CPA.