Steve Hamilton is a Tampa native and a graduate of the University of South Florida and the University of Missouri. He now lives in northern Kentucky. A career CPA, Steve has extensive experience involving all aspects of tax practice, including sophisticated income tax planning and handling of tax controversy matters for closely-held businesses and high-income individuals.

Thursday, November 23, 2023

Saturday, November 18, 2023

Another Backup Withholding Story

We talked not

too long ago about backup withholding.

What is it?

Think Forms

1099 and you are mostly there.

The IRS

wants reporting for many types of payments, such as:

· Interest

· Dividends

· Rents

· Royalties

· Commissions and fees

· Gambling winnings

· Gig income

Reporting requires

an identification number, and the common identification number for an

individual is a social security number.

The IRS

wants to know that whoever is being paid will report the income. The payor starts

the virtuous cycle by reporting the payment to the IRS. It also means that – if

the payee does not provide the payor with an identification number - the payor

is required to withhold and remit taxes on behalf of the payee.

You want to

know how this happens … a lot?

Pay someone

in cash.

There is a

reason you are paying someone in cash, and that reason is that you probably

have no intention of reporting the payment – as a W-2, as a 1099, as anything –

to anyone.

It is all

fun and games until the IRS shows up. Then it can be crippling.

I had the following bright shiny drop into my office recently:

The client

filed the 1099 and also responded to the first IRS notice.

It could

have gone better.

That 24% is

backup withholding, and I am the tax Merlin that is supposed to “take care of”

this. Yay me.

This case was

not too bad, as it involved a single payee.

How did it

happen?

The client issued

a 1099 to someone without including a social security number. They filled-in “do

not know” or “unknown” in the box for the social security number.

Sigh.

Sometimes you

do not know what you do not know.

Here is a

question, and I am being candid: would I send in a 1099 to the IRS if I did not

have the payee’s social security number?

Oh, I understand

the ropes. I am supposed to send a 1099 if I pay someone more than $600 for the

performance of services and yada yada yada. If I don’t, I can be subject to a

failure to file penalty (likely $310). There is also a failure to provide penalty

(likely $310 again). I suppose the IRS could still go after me for the backup

withholding, but that is not a given.

Let me see: looks

like alternative one is a $620 given and alternative two is a $38,245 given.

I am not

saying, I am just saying.

Back to our

bright shiny.

What to do?

I mentioned

that the payment went to one person.

What if we

obtained an affidavit from that person attesting that they reported the payment

on their tax return? Would that get the IRS to back down?

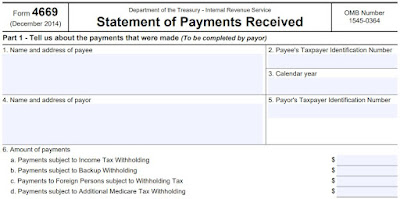

It happens enough that the IRS has a specific form for it.

We filled in

the above form and are having the client send it to the payee. We are

fortunate, as they have a continuing and friendly relationship. She will sign, date,

and return the form. We will then attach a transmittal (Form 4670) and send the

combo to the IRS. The combo is considered a penalty abatement request, and I am

expecting abatement.

Is it a

panacea?

Nope, and it

may not work in many common situations, such as:

(1) One never obtained payee contact information.

(2) A one-off transaction. One did not do

business with the payee either before or since.

(3) The payee moved, and one does not

know how to contact him/her.

(4) There are multiple payees. This could

range from a nightmare to an impossibility.

(5) The payee does not want to help, for whatever

reason.

Is there a

takeaway from this harrowing tale?

Think of

this area of tax as safe:sorry. Obtain identification numbers (think Form W-9)

before cutting someone their first check. ID numbers are not required for

corporations (such as the utility company or Verizon), but one is almost

certainly required for personal services (such as gig work). I suppose it could

get testy if the payee feels strongly about seemingly never-ending tax reporting,

but what are you supposed to do?

Better to

vent that frustration up front rather than receive a backup withholding notice

for $38,245.

And wear out

your CPA.

Sunday, November 12, 2023

The EV Tax Credit

I was reading an article recently that approximately 40% of Americans have not heard about the EV tax credits.

EVs are battery

powered cars. We used to have hybrids, which sometimes used a motor and other

times a battery. EVs by contrast are 100% battery powered.

If you are

thinking about buying one for personal use, here are a few markers to keep in

mind:

(1) There was an OLD tax credit and now there is a

NEW tax credit.

a. The OLD credit went through April 18,

2023.

b. The NEW credit of course is after

April 18, 2023.

Both credits can get up to $7,500, so what changed was the

measuring stick.

Before April 19, the EV had to be assembled in North America.

After April 18, one test became two tests:

· The battery itself has to be

manufactured in North America, and

· Then critical minerals in the battery

(cobalt and lithium, for example) must be extracted or processed in the U.S. or

in a country with which the U.S. has a free trade agreement.

Notice that OLD $7,500 credit (assembled in North America)

has become two NEW credits of $3,750 each. You can get to $7,500, but along a

different route.

It matters. For example, the new Ford Mustang Mach-E only

qualifies for one of the credits – only $3,750 – because its battery comes from

abroad.

Some – like the Genesis GV70 – used to qualify for the old

$7,500 credit but no longer qualify for anything under the new rules.

If you are considering an EV, please double check whether the

vehicle qualifies. Here is the Department of Energy’s website:

https://fueleconomy.gov/feg/tax2023.shtml

(2) Congress included some price caps on qualifying

vehicles. These things are expensive, and Congress was trying to exert downward

pressure.

To qualify,

· A van, SUV or pickup truck must cost

$80 grand or less.

· Any other vehicle (a sedan, for example) must cost $55 grand or less.

(3) Starting in 2024, you will have the option of using the credit immediately when you purchase the vehicle. It would make for an easy down payment, I suppose.

The heavy lifting is done behind the scenes, as the dealerships will register on a new website to initiate and receive the credits. If you are curious, that website is:

(4) For the first time, used EVs will qualify for

a credit. This credit will not be as large as the one for new EVs, but it is

not insignificant either. Here are the ropes:

· The price must be $25 grand or less.

· The car must be at least two years

old.

· The car qualifies only once in its

lifetime.

· The credit is up to $4 grand, limited

to 30% of the price.

· You can claim the used EV credit once every three years.

(5) There are income limits on both the new EV and used EV credits. Make too much money and you will not qualify.

For example:

New EV

Married income < $300,00

Single income < $150,000

Used EV

Married income < $150,000

Single

income < $75,000

You can test for income either in the year of purchase or the immediately preceding year. I am thinking – to be safe – that one should generally go with the preceding year. It would be no fun to apply a $7,500 credit against the purchase of an EV and then give it back because you reported too much income on your 2024 tax return.

(6) Up to now, we have been talking about buying an

EV for personal use. There is a similar credit if you lease rather than buy,

but some rules are different.

· Since the leasing company (and not

you) owns the vehicle, the income test does not apply.

· The credit requires the EV be manufactured

by a “qualified manufacturer” rather than the two-step qualification discussed

above for a purchased vehicle. This should result in a wider selection.

· Mind you, the leasing company is not required to pass (all or any of) this credit on to you. Education is important here - and expect negotiation.

The reason the rules are different is that this second credit is designed for businesses – rather than individuals – buying an EV. By bringing in a leasing company, we flipped from the first to the second credit.

I am not in the market for a car myself. If I were, though, I would go in a very different direction.

Sunday, November 5, 2023

Another Runaway FBAR Case

Let’s talk about the FBAR (Report of Foreign Bank and

Financial Accounts). It currently goes by the name “FinCen Form 114.”

This thing has been with us since 1970. It came to life as an effort to identify foreign financial transactions that might indicate money laundering or tax evasion.

Sounds benign.

The filing requirement applies to a United States

person, defined as

· A

citizen or resident of the U.S.

· A

domestic partnership

· A

domestic corporation

· A

domestic trust or estate

We’ll come back

that first one in a moment.

Next, one needs a financial interest or signature

authority in a foreign financial account to trigger this thing.

A foreign financial account includes a bank account,

which is easy enough to understand. It would also include a broker account

(think Charles Schwab, but overseas). Some are not so intuitive, though.

· A

foreign insurance policy with cash value is reportable.

· A

foreign hedge fund is not.

· A

foreign annuity policy is reportable.

· A

foreign private equity fund is not.

· A

foreign cryptocurrency account is not reportable.

Some require a google search to understand what is

being said.

· A

Canadian registered retirement savings plan is reportable.

· A

Mexican fondo para retiro is reportable.

Next, the foreign financial account has to exceed a certain

dollar balance ($10,000) at some point during the year.

That $10,000 balance has been there for as long as I

can remember. You will have a hard time persuading me that $10,000 in 1986 is

the same as $10,000 now, but that number is apparently eternal and unchanging.

The $10,000 is tested across all foreign financial

accounts. If it takes your fourth foreign account to put you over $10 grand,

then you are over. Testing is done. All your accounts are reportable on a FBAR.

Like so many things, the FBAR started with reasonable

intentions but has morphed into something near unrecognizable.

Fail to file an FBAR and the standard penalty is $10

grand. Fail to file for two years and the penalty is $20 grand. Have two

foreign accounts and fail to file for two years and the penalty is $40 grand.

And that is assuming the error is unintentional. Do it

on purpose and I presume they will execute you.

I exaggerate, of course. They will just bankrupt you.

It puts a lot of pressure on defining “on purpose.”

Let’s look at Osamu Kurotaki (OK).

OK was born in Japan and lives in Japan. He obtained a

U.S. green card, making him a U.S. permanent resident. One of the pleasures of

being a permanent resident is filing an annual tax return with the United

States, irrespective of whether you live in the U.S. or not. One can talk about

a foreign income exclusion or foreign tax credit – which is fine – but that

annual filing makes sense only if someone intends to eventually return to the U.S.

It does not make as much sense if someone does not intend to return, someone

like OK.

OK paid someone to prepare his annual U.S. tax

return. He found a CPA who was bilingual.

In 2021 the U.S. Treasury assessed civil penalties

against OK for more than $10 million. His footfall? He failed to file FBARs.

Treasury also upped the ante by saying that his failure was “willful.”

Huh?

Treasury is requesting summary judgement that OK

willfully failed to file FBARs, prefers waffle over sugar cones and rooted for

the Diamondbacks in the World Series.

The Court wanted to know how Treasury climbed the ladder to get to that “willful” step.

So do I.

Here is what the Court saw:

· OK

is a Japanese speaker and does not speak English “at all.”

· OK

relied on his bilingual CPA to make sense of U.S. tax filing obligations.

· His

CPA provided annual tax questionnaires in both English and Japanese. The

English was for theater, I suppose, as OK could not read English.

· The

CPA’s translation now becomes critical. Here are instructions to the FBAR in

English:

U.S. taxpayers

are required to report their worldwide income; that is, income from both U.S.

and foreign sources.”

· Here

is the Japanese translation:

U.S. resident taxpayers

are required to report their worldwide income, that is, income from both US. and

foreign sources."

OK told the Court that he did not think he had a

filing obligation because he was not a “U.S. resident.”

I get it. He lives in Japan. He works in Japan. His

kids go to school in Japan. He is as much a “U.S. resident” as I am a Nepalese

Sherpa.

Except …

OK was green card – that is, a “permanent” resident of

the U.S.

Technically …

The Court cut OK some slack. Technically - and in a

law school vacuum - he was a “resident.” Meanwhile - in the real world – no one

would think that. Furthermore, OK hired a CPA who made a mistake. Even a trained

professional erred interpreting the Treasury’s word salad.

The Court said “no” to summary judgement.

Treasury will have to argue its $10 million-plus proposed

penalty.

And I believe the Court just outlined reasonable

cause.

Perhaps OK should consider turning in that green card.

Our case this time was Osamu Kurotaki v United

States, U.S. District Court, District of Hawaii.